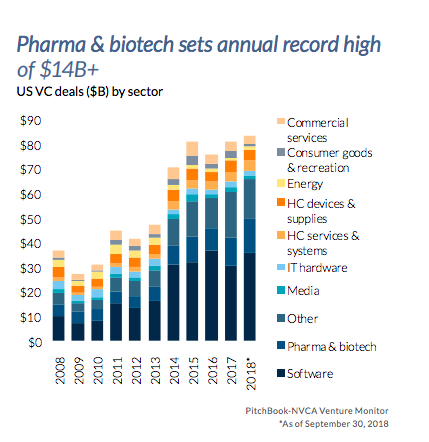

The U.S. venture capital space is primed for another record-setting year of investment, with billions of dollars flowing into the healthcare industry. As of September 30, VC firms pumped $23.4 billion into healthcare, according to Pitchbook’s quarterly report.

Deal volume reached $84.3 billion in the third quarter of 2018, exceeding the $82 billion in 2017. By the end of the third quarter, more than 6,500 deals had closed, including 548 in pharma and biotech, 376 in healthcare services and systems, and 433 in healthcare devices and supplies, for a total of $23.4 billion invested.

Corporate VC investment has already surpassed 2017 levels, according to the report. By the third quarter of 2018, corporate VCs had participated in $39.3 billion worth of venture financings. By comparison, corporate VCs contributed $15.2 billion in 2013. Year over year, the number of deals during the third quarter declined slightly, but transactions are still expected to surpass 1,400 by year end for the fourth consecutive year.

Another growing trend in 2018 is larger deals, with the number of transactions valued at $50 million or above jumping from 2017 levels. Corporate VC investments have increasingly concentrated in the higher-end deals, as well, with 34.5 percent of deals valued $25 million or larger.

In a trend reversal, angel and seed quarterly deal value dropped in the third quarter from the second, but remained in range of the last 16 quarters.